Gross tax revenue pegged at Rs 44.04 lakh crore for FY27; direct taxes to lead growth as Centre banks on compliance gains and steady GDP expansion

Finance Minister Nirmala Sitharaman has set an ambitious gross tax revenue target of Rs 44.04 lakh crore for FY27, betting on sustained economic momentum and improved compliance to fund higher capital expenditure while staying the course on fiscal consolidation.

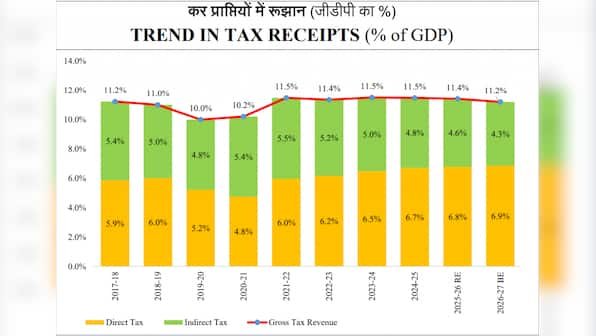

Presenting the Union Budget 2026-27, Sitharaman projected gross tax collections to rise to Rs 44,04,086 crore, or 11.2 per cent of GDP, in the fiscal beginning April 1, marking a 3.1 per cent increase over the previous year’s Budget estimate of Rs 42,70,233 crore and a healthy jump over the revised estimate for FY26 of Rs 40,77,772 crore.

Direct taxes remain the backbone

Corporation tax collections are projected at Rs 12.31 lakh crore, or 6.9 per cent of GDP, in FY27, up from Rs 11.09 lakh crore in the current fiscal (revised estimate).

Personal income tax receipts are pegged at Rs 14.66 lakh crore, compared with Rs 13.12 lakh crore in FY26 (RE).

Together, corporation tax and income tax will account for more than half of the gross tax revenue.

On the indirect tax front, Goods and Services Tax (GST) collections are estimated at Rs 10.19 lakh crore for FY27, slightly lower than the revised estimate of Rs 10.46 lakh crore for FY26.

Customs duty collections are projected to rise to Rs 2.71 lakh crore, up from Rs 2.58 lakh crore in FY26 (RE), indicating expectations of resilient import demand and calibrated tariff measures.

Union excise duties are estimated at Rs 3.89 lakh crore for the next fiscal, compared with Rs 3.37 lakh crore this year, aided by stable fuel consumption and duty adjustments.

End of Article