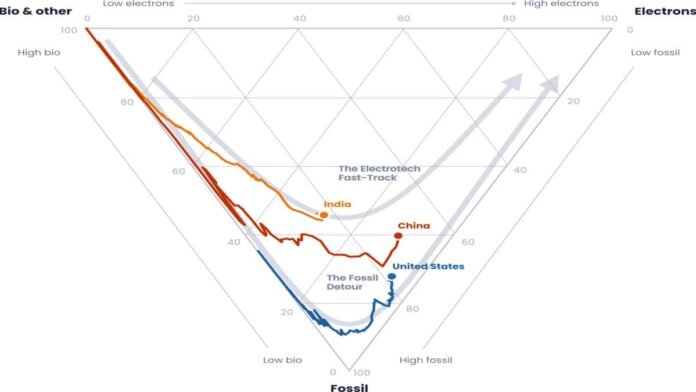

A new Ember report finds India is electrifying its economy faster than China did at a similar income level, while using far less coal and oil per person — signalling a cheaper, cleaner growth model for emerging economies

China’s rapid electrification is often seen as an economic miracle. But new research shows India may be doing even better, electrifying faster while using far less fossil fuel per person than China did at a similar stage of development.

According to a report by energy think tank Ember, India is showing that clean electricity can power growth without a long dependence on coal and oil, offering a faster and more practical development path for emerging economies.

“The orthodox narrative has been that emerging markets must follow the same path the West and China took — from biomass to fossil fuels and only then to clean energy,” Kingsmill Bond, strategist at Ember and one of the report’s authors, told Bloomberg News. “India shows that this is no longer inevitable,” he said.

A fairer comparison with China

To compare India and China, Ember adjusted both countries’ gross domestic product for purchasing power, accounting for differences in the cost of living. On that basis, India’s current per-capita income of about $11,000 is roughly equivalent to China’s income level in 2012.

India today is electrifying its economy faster than China did at a similar income level while using significantly less coal and oil per person.

At comparable stages of development, India’s per-capita consumption of coal and oil is only a fraction of China’s. Even in absolute terms, India’s fossil fuel use is rising more slowly today than China’s does now, despite India being at an earlier stage of industrialisation.

200&&loadTaboolaIframe()})]]>

A transition with contradictions

None of this means India has broken free from fossil fuels. Coal remains the backbone of its power system, and the government is considering plans that could double coal-fired capacity by 2047. Oil demand, meanwhile, is still rising rapidly, and India’s consumption growth was expected to outpace China’s last year.

Yet the broader trajectory is different. As green electricity expands, fossil fuels are playing a smaller role per person than they once did in China.

India is benefiting from dramatically cheaper solar panels, batteries and electric vehicles, technologies that were far more expensive when China began its electrification drive more than a decade ago.

Electric vehicles change the oil story

The impact is already visible on India’s roads. In 2024, electric vehicles accounted for about 5 per cent of new car sales in the country. When China reached the same milestone, its per-capita oil consumption for road transport was around 60 per cent higher than India’s is today.

As a result, India’s oil demand trajectory may look fundamentally different. Bond argues that India’s peak road-transport oil consumption per person is unlikely ever to reach Chinese levels.

That matters not just for emissions, but for energy security and economic resilience.

The rise of the ‘electrostate’

Bond and his colleagues at Ember believe India is an early example of what they call an electrostate, a country that meets most of its energy needs through electricity, increasingly generated from clean sources, rather than through domestically extracted fossil fuels.

No country fully fits that description yet. But the trend is clear. As the costs of solar power, batteries, electric vehicles and associated minerals continue to fall, the advantages of electrification become even more compelling for countries poorer than India today.

Crucially, the motivation is not climate altruism.

“Neither India nor China is going electric primarily to cut emissions,” Bond told Bloomberg News. “They’re doing it because it makes economic sense,” he said.

For India, the economics are particularly stark. The country imports more than 40 per cent of its primary energy, coal, oil and gas, according to the International Energy Agency. That dependence translates into a fossil-fuel import bill of roughly $150 billion a year.

“To grow and to have energy independence, India has to reduce that terrible burden,” Bond said. “It needs other solutions.”

The China bottleneck

Yet India’s green leap comes with a strategic vulnerability. China today dominates global manufacturing across the electricity technology supply chain.

That dominance can become a bottleneck. Beijing has already shown its leverage, using control over rare earths and other inputs to extract concessions in trade disputes, including tariff negotiations with the United States.

Chinese firms also control much of the specialised equipment needed to build domestic manufacturing capacity elsewhere. That has real-world consequences. This month, Reliance Industries paused plans to manufacture lithium-ion battery cells in India after failing to secure key equipment from China.

End of Article